buying chanel in paris vat refund | where to get a vat refund buying chanel in paris vat refund The VAT refund process usually involves obtaining a VAT refund form from the retailer, having it stamped by customs or scanned through a machine when leaving the . Buy Now. Bottle cost: £25.83. The spices become warmer and more developed. They are joined by thick honey and vanilla notes that take cues directly from the oak. The toffee melts away into a steady caramel stream that creates a .

0 · where to get a vat refund

1 · stores with no vat refund

2 · how much is vat refund uk

3 · high end stores with vat refund

4 · Chanel goyard vat refund

ABSEILING. Experience the thrill of descending skilfully from great heights, surrounded by stunning scenery. Your abseil experience starts with a brief introduction and the issuing of safety equipment. Once all formalities are complete, you will be briefed on the procedures of safe abseil technique by our experienced coordinators.

where to get a vat refund

Refunds are given for simultaneous purchases (purchases made at one time, at one location) which exceed approximately 170€. In all cases, merchandise for which a VAT .

If you are buying designer pieces on your French vacation, you’ll want to make sure to get that refund. Currently the vat rate is 20% , which is nothing to sneeze at on luxury .

The VAT refund process usually involves obtaining a VAT refund form from the retailer, having it stamped by customs or scanned through a machine when leaving the .

By getting a VAT refund with the Wevat tax refund app, you can expect to save up to 13% on your purchases! Here’s what you need to know before shopping and a guide on how to get a tax .So as long as you're in the EU, you can get your VAT declaration or refund at your departing airport within the EU. Example: before UK left the EU, I would go to Paris and purchase my . Today I'm showing you what I purchased in Paris AND explaining how the VAT Refund works! When luxury shopping in Paris, or just shopping in Europe, from high.

Discover the ultimate guide to luxury tax-free shopping in Paris, including the VAT refund process. Learn how to navigate tax-free departments, process your forms at Charles de . If I buy a Chanel purse at Chanel and it’s brand new, I get a full VAT refund at the airport, correct? If I buy a used/second hand Chanel from a store, because its used I will not get my VAT refund.

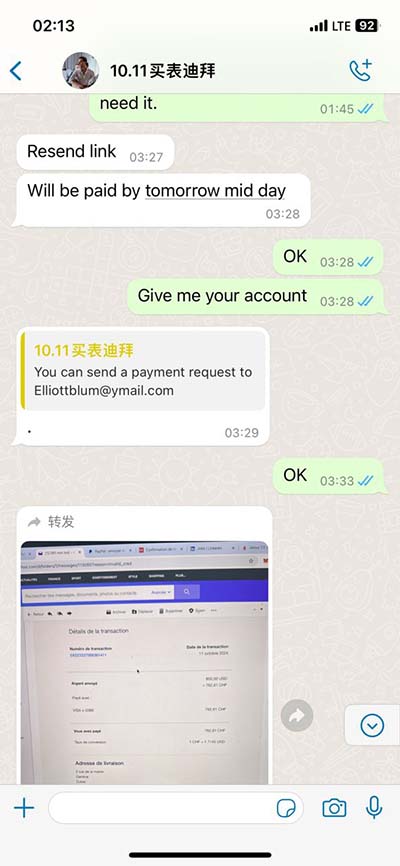

Refunds are given for simultaneous purchases (purchases made at one time, at one location) which exceed approximately 170€. In all cases, merchandise for which a VAT refunded is given or requested must be shown in an unused condition at . If you are buying designer pieces on your French vacation, you’ll want to make sure to get that refund. Currently the vat rate is 20% , which is nothing to sneeze at on luxury items. So for any of you dreaming about buying your . The VAT refund process usually involves obtaining a VAT refund form from the retailer, having it stamped by customs or scanned through a machine when leaving the country, and then submitting it for a refund, either at the airport or via mail.By getting a VAT refund with the Wevat tax refund app, you can expect to save up to 13% on your purchases! Here’s what you need to know before shopping and a guide on how to get a tax refund for purchases from luxury fashion retailers like Louis Vuitton, Chanel, etc.

So as long as you're in the EU, you can get your VAT declaration or refund at your departing airport within the EU. Example: before UK left the EU, I would go to Paris and purchase my goodies, and when I left the EU via UK I got my VAT forms stamped and either refunded there or .Today I'm showing you what I purchased in Paris AND explaining how the VAT Refund works! When luxury shopping in Paris, or just shopping in Europe, from high. Discover the ultimate guide to luxury tax-free shopping in Paris, including the VAT refund process. Learn how to navigate tax-free departments, process your forms at Charles de Gaulle Airport, and indulge in duty-free shopping. Planning a trip to Paris and considering making a purchase over there because of the VAT refund I have been hearing so much about. Does anyone know whether the tag price includes tax? And if you have done this before, how much did you save?

stores with no vat refund

how much is vat refund uk

In general, Chanel offers a 12% tax refund on their products. This means that if you spend €1,000 on Chanel products in Paris, you’ll receive a €120 refund. How to claim your VAT refund. To claim your VAT refund at Chanel in Paris, follow these steps: If I buy a Chanel purse at Chanel and it’s brand new, I get a full VAT refund at the airport, correct? If I buy a used/second hand Chanel from a store, because its used I will not get my VAT refund. Refunds are given for simultaneous purchases (purchases made at one time, at one location) which exceed approximately 170€. In all cases, merchandise for which a VAT refunded is given or requested must be shown in an unused condition at .

If you are buying designer pieces on your French vacation, you’ll want to make sure to get that refund. Currently the vat rate is 20% , which is nothing to sneeze at on luxury items. So for any of you dreaming about buying your .

The VAT refund process usually involves obtaining a VAT refund form from the retailer, having it stamped by customs or scanned through a machine when leaving the country, and then submitting it for a refund, either at the airport or via mail.By getting a VAT refund with the Wevat tax refund app, you can expect to save up to 13% on your purchases! Here’s what you need to know before shopping and a guide on how to get a tax refund for purchases from luxury fashion retailers like Louis Vuitton, Chanel, etc. So as long as you're in the EU, you can get your VAT declaration or refund at your departing airport within the EU. Example: before UK left the EU, I would go to Paris and purchase my goodies, and when I left the EU via UK I got my VAT forms stamped and either refunded there or .Today I'm showing you what I purchased in Paris AND explaining how the VAT Refund works! When luxury shopping in Paris, or just shopping in Europe, from high.

Discover the ultimate guide to luxury tax-free shopping in Paris, including the VAT refund process. Learn how to navigate tax-free departments, process your forms at Charles de Gaulle Airport, and indulge in duty-free shopping. Planning a trip to Paris and considering making a purchase over there because of the VAT refund I have been hearing so much about. Does anyone know whether the tag price includes tax? And if you have done this before, how much did you save?

high end stores with vat refund

Chanel goyard vat refund

Wish you could find out if your study abroad dream will come true ahead of time? It's .

buying chanel in paris vat refund|where to get a vat refund